Form 1096 Instructions

Form 1096 Is An Accompaniment to Form 1099-R...

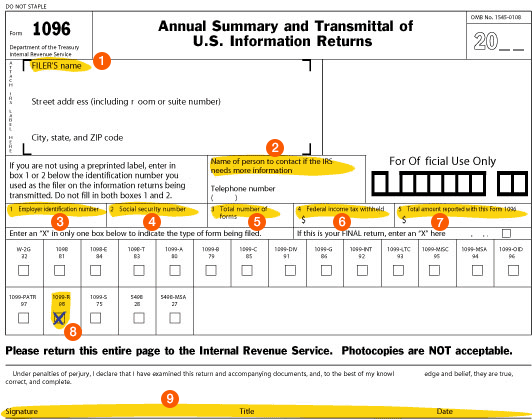

IRS Form 1096 Annual Summary and Transmittal of U.S. Information Returns is a sort of cover page to any Form 1099-Rs being filed.

- Use Form 1099-R to report per-distribution information, such as the recipient's name and distribution amount.

- Use Form 1096 to give the IRS summary information, such as the number of 1099-Rs being filed and contact information for your 401k plan administrator.

This one page form is due to the IRS by February 28 of each year as an accompaniment to any Form 1099-Rs being filed.

Form 1096 Samples and Instructions

Page 1 of 1

Form 1096: Annual Summary and Transmittal of U.S. Information Returns

- Print or type in your company name and street address exactly as they appear on the Form 1099-R(s) that will accompany the 1096.

- Print or type in the name and phone number of your Plan Administrator as the "person to contact if the IRS needs more information."

- Box 1: Print or type in your company's tax ID number. (See your plan's Adoption Agreement, page 1, item A4.)

- Box 2: Leave blank.

- Box 3: Number of 1099-R(s) you're sending in.

- Box 4: Total of the amount(s) in Box 4 of the accompanying 1099-R(s).

- Box 5: Total of the amount(s) in Box 1 of the accompanying 1099-R(s).

- Mark off the box below "1099-R 98" to indicate the type of accompanying Form that's being filed.

- Sign and date the Form.

That's it!