The IRS Requires 401k Plan Sponsors to File Form 1099-R and Form 1096 if any Taxable 401k Distributions

BY JANUARY 31st OF THE NEW YEAR, the IRS requires a completed Form 1099-R be provided to each person who has taken a taxable distribution from the 401k in the previous year. In addition, an IRS Form 1096 must be completed and filed with the IRS no later than February 28.

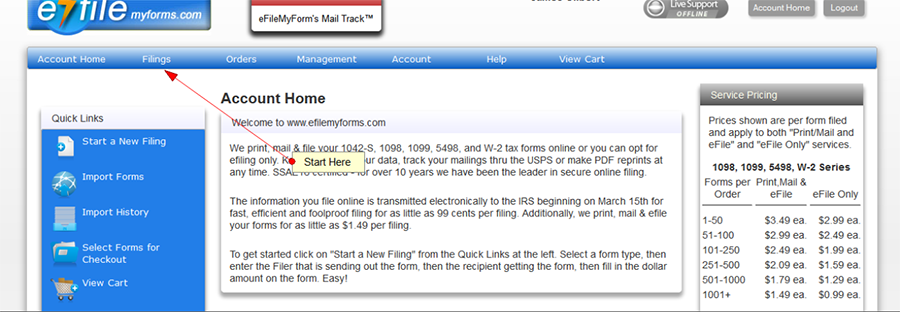

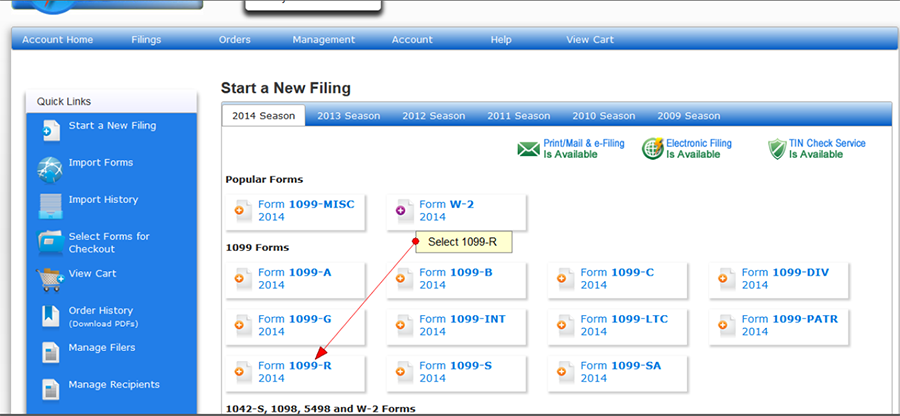

We recommend an easy-to-use, low cost online service to prepare and file the 1099R and 1096 forms. The service is called e File My Forms (www.efilemyforms.com) and it takes just a few minutes to navigate the site and prepare and send the required 1099Rs and 1096. Attached are two sample screen-shots to help you get started.

We have no business relationship with e File My Forms, and earn no compensation from them---we recommend them simply because they ascribe to our business philosophy--low cost, easy-to-use online services to help you run your 401k efficiently and economically.

Do-It-Yourself Form 1096 Instructions