Form 1099-R Instructions

Use Form 1099-R to report information, such as the recipient's name and distribution amount, on each distribution made from your 401(k)plan during the plan year.

Form 1099-R is a one-page form that is comprised of six identical forms:

- Copy A is for the IRS and is due by February 28 of each year.

- Copy 1 is for your state, city or local tax department and due as stipulated by the relevant party.

- Copy B is for the IRS as an accompaniment to your annual federal return.

- Copy C is for the distribution recipient and is due to that person by January 31.

- Copy 2 is for the recipient to file with the relevant state, city or local tax department, as needed.

- Copy D is for your plan records.

Form 1096 Samples and Instructions

Page 1 of 1

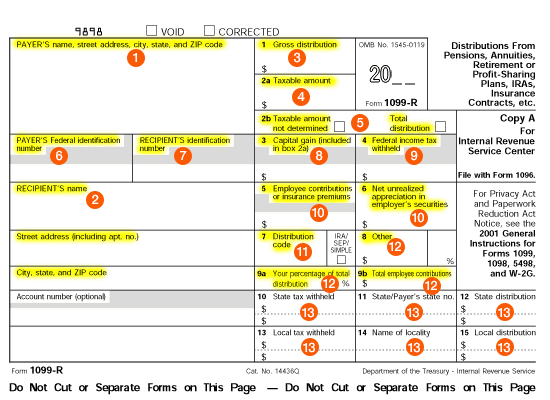

Form 1099-R: Distributions From Pension, Annuities, Retirement or Profit-Sharing Plans

- Payer's name: Print or type your company name and street address exactly as on the Form 1096.

- Recipient's name: Print or type the name and address of the employee who received the distribution (address information is recorded in your 401k software's Employee Information).

- Box 1: The amount listed for the employee on the Year-to-Date Activity Summary by Employee report you printed from your 401k plan administration software.

- Box 2a: If the amount in Box 1 was a lump-sum distribution, enter the same amount in Box 2a. If the amount in Box 1 was a rollover to a qualified plan or IRA, enter 0.

- Boxes 2b: Leave "Taxable amount not determined" unchecked. Check "Total distribution" if all funds were distributed from the account as of year's end (i.e., no balance remains in the account).

- Payer's Federal identification number: Type in your employer ID number (see your plan's Adoption Agreement, page 1, item A4).

- Recipient's identification number: The employee's social security number.

- Box 3: Leave blank.

- Box 4: Type in the tax withheld, if any; 20 percent of the distribution for lump-sum distributions.

- Boxes 5 and 6: Leave blank.

- Box 7: See IRS instructions pages R9-10 for a list of codes. Your distributions will most likely be one of the following, as defined in the aforementioned list of codes: 1, G, H, 7, 8 or L.

- Boxes 8, 9a and 9b: Leave blank.

- Boxes 10-15: Complete as needed. Not applicable in most states.