Form 5558 Instructions

From your 401k software

These instructions reference the following reports and documents from your 401k software and companion materials:

- Adoption Agreement

Form 5558 Is For Applying For a Time Extension to File

Use IRS Form 5558 to apply for a time extension to file your Form 5500-EZ or your Form 5500 and its accompanying Schedules, all of which are normally due on July 31st (for non January to December plan years, by the last day of the seventh month after the close of your plan year).

You Can Print Form 5558 From This Site...

IRS Form 5558 is one of the only forms that does NOT have to be processed on IRS pre-printed forms that use special inks. You can thus print a useable version of Form 5558 from this website (or from the IRS website).

Form 5558 Samples and Instructions

Page 1 of 1

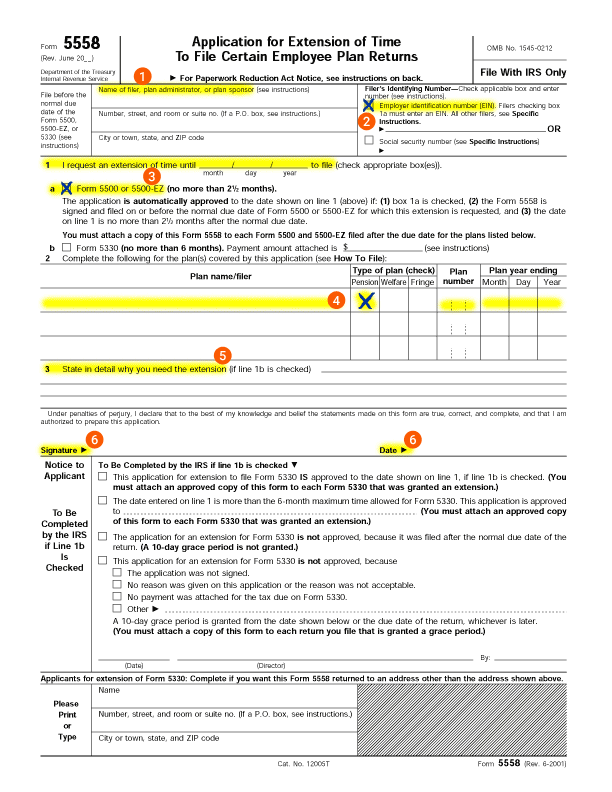

Form 5558: Application for Extension of Time to File Certain Employee Plan Returns (text only)

- Type or print your company name and address.

- Filer's Identifying Number: Check "Employer identification number" and enter your EIN, as recorded on page 1 of your Adoption Agreement, item A4.

- items 1a-b: Fill in the desired month/day/year, making sure you're asking for no more than the stipulated 2 1/2 month extension, then check box "a".

- item 2: For Plan name, use that typed on your Adoption Agreement page 2, item B1; for Type of plan, check "Pension"; for Plan number, use that indicated in your Adoption Agreement page 3, item B5; for Plan year ending, enter 12-31-(insert applicable year).

- item 3: Leave blank.

- Sign and date the form.

That's it!